ct sales tax exemptions

FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. View examples of individual items that are exempt or taxable during Sales Tax Free Week.

Sales And Use Tax Regulations Article 3

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

. 2 Get a resale certificate fast. Sales and Use Tax Exempt Status Certificate ex50e. State Tax Exemption - Colorado Denver StateTaxExemption-Colorado - SECURED.

The statewide sales tax is 635 for the retail sale lease or rental of most goods and taxable services. Ad Lookup Sales Tax Rates For Free. Sales and use tax exemption.

Ad New State Sales Tax Registration. FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Interactive Tax Map Unlimited Use.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. General Sales Tax Exemption Certificate.

Download Or Email OS-114 More Fillable Forms Register and Subscribe Now. 2022 Connecticut state sales tax. You may apply for tax relief on the purchase of.

What is tax-exempt during CTs tax-free week. 12-412 Exemptions Policy Statement 20151 DC CDCR 9-419 Sales and Use tax CDCR 9-492. Factors determining effective date thereof.

2022 Sales Tax Free Week dates are Sunday August 21 through Saturday August 27 2022. Ad Access Tax Forms. Exemption from sales tax for items purchased with federal food stamp coupons.

Use tax exemptions may apply for certain family andor corporate transfers. Page 1 of 1 Tax Exemption Programs for Nonprofit Organizations CT Use Tax for Individuals Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. There are separate sales tax exemptions meant for sales by non-dealers but the was purchaser subject to use tax.

Download Or Email OS-114 More Fillable Forms Register and Subscribe Now. Exact tax amount may vary for different items. Exact tax amount may vary for different items.

Complete Edit or Print Tax Forms Instantly. Ad Lookup Sales Tax Rates For Free. There are exceptions to the 635 sales and use tax rate for certain goods and services.

7 on certain luxury motor vehicles jewelry clothing and footwear. Because Connecticut has just one sales tax and no discretionary taxes it is very easy to calculate your tax liability. Ad Access Tax Forms.

SalesTaxHandbook has an additional five Connecticut sales tax certificates that you may need. There are exceptions to the 635 sales and use tax rate for certain goods and services. Complete Edit or Print Tax Forms Instantly.

What is CTs sales tax. This is the second sales tax holiday of 2022 in Connecticut after a similar tax holiday ran from April 10. Agile Consulting Groups sales tax consultants can be.

During the one-week sales tax holiday most clothing and footwear items priced under 100 are exempt from the Connecticut sales tax. Manufacturing and Biotech Sales and Use. 44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut.

Manufacturing and Biotech Sales and Use. How to use sales tax exemption certificates in Connecticut. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation.

Ad 1 Fill out a simple application. Are drop shipments subject to sales tax in Connecticut. 7 on certain luxury motor vehicles boats jewelry clothing and.

As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability. 2022 Connecticut state sales tax. The exemption during Sales Tax Free Week applies to.

Interactive Tax Map Unlimited Use. FYI Sales 63 Notice see p7 Connecticut Conn. Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which.

State Sales Tax Exemptions information registration support. The exemption will cover a range of items from clothing to footwear tha. State Tax Exemption - Connecticut for Exempt.

This page discusses various sales tax exemptions in. Page 1 of 1 Tax Exemption Programs for Nonprofit Organizations CT Use Tax for Individuals Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100. Investments that help your business create jobs and modernize may be eligible for tax relief including.

Calculating Connecticuts sales and use tax rates. Exemption from sales tax for services.

Exemptions From The Connecticut Sales Tax

Sales Taxes In The United States Wikiwand

Sales Tax Exemption For Building Materials Used In State Construction Projects

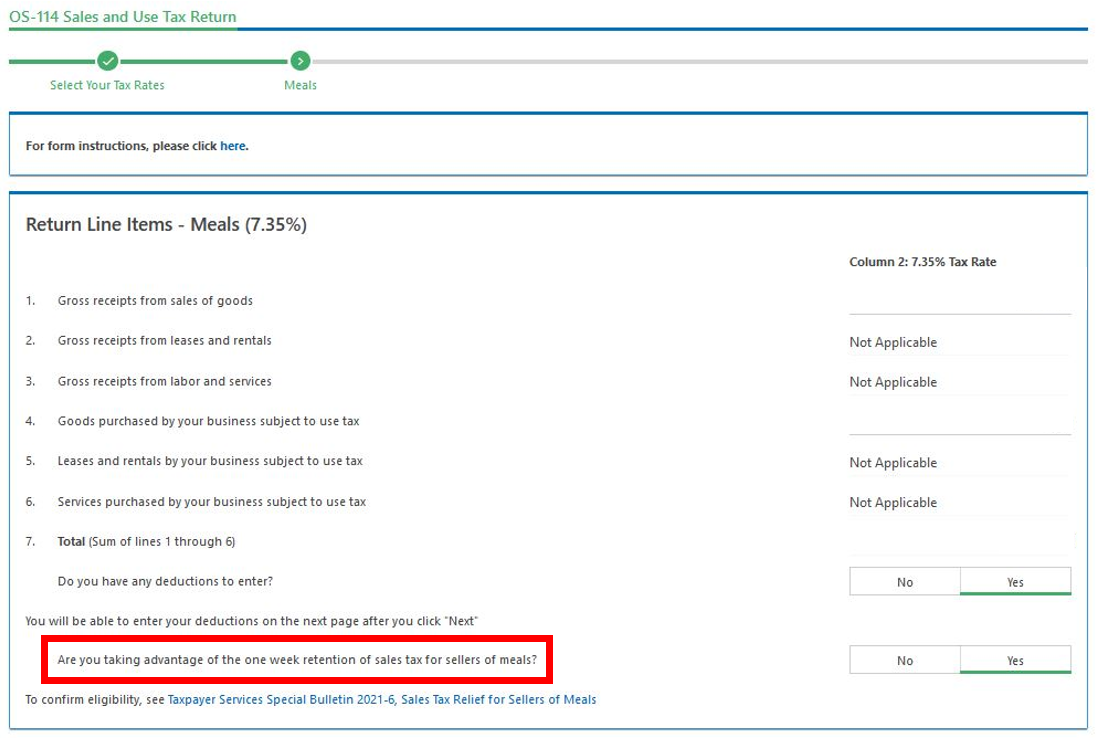

Sales Tax Relief For Sellers Of Meals

Pennsylvania Sales Tax Small Business Guide Truic

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States Sales Taxes On Software Tax Software Software Sales Marketing Software

Sales Tax Exemptions Finance And Treasury

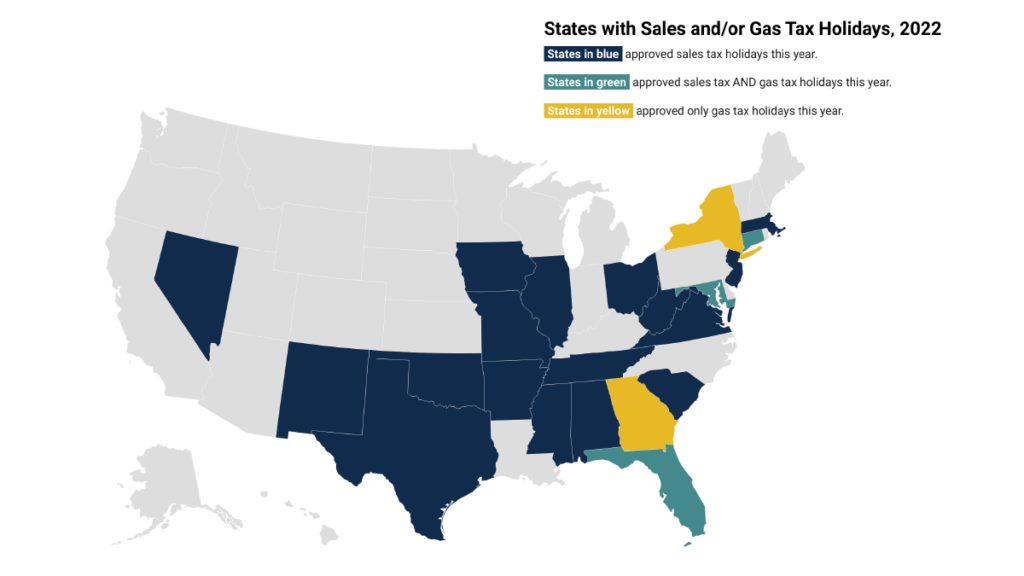

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Automated Sales Tax Needs To Be Turned Off Period In Texas We Have To Charge The Sales Tax Rate For Whatever City We Are Serving

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How Do State And Local Sales Taxes Work Tax Policy Center

Sales And Use Tax Regulations Article 3

Report Ct Never Came Up With Plan To Collect More Online Sales Tax